The IPO of Enviro Infra Engineers Limited has garnered significant interest from investors, given its robust subscription figures and promising premium in the grey market. Below is an overview of the key aspects related to the IPO allotment status.

IPO Details:

- Offer Dates:

The IPO was open for subscription from November 22, 2024, to November 26, 2024. - Offer Price Range:

The share price band was set at ₹140 to ₹148 per share. - Lot Size:

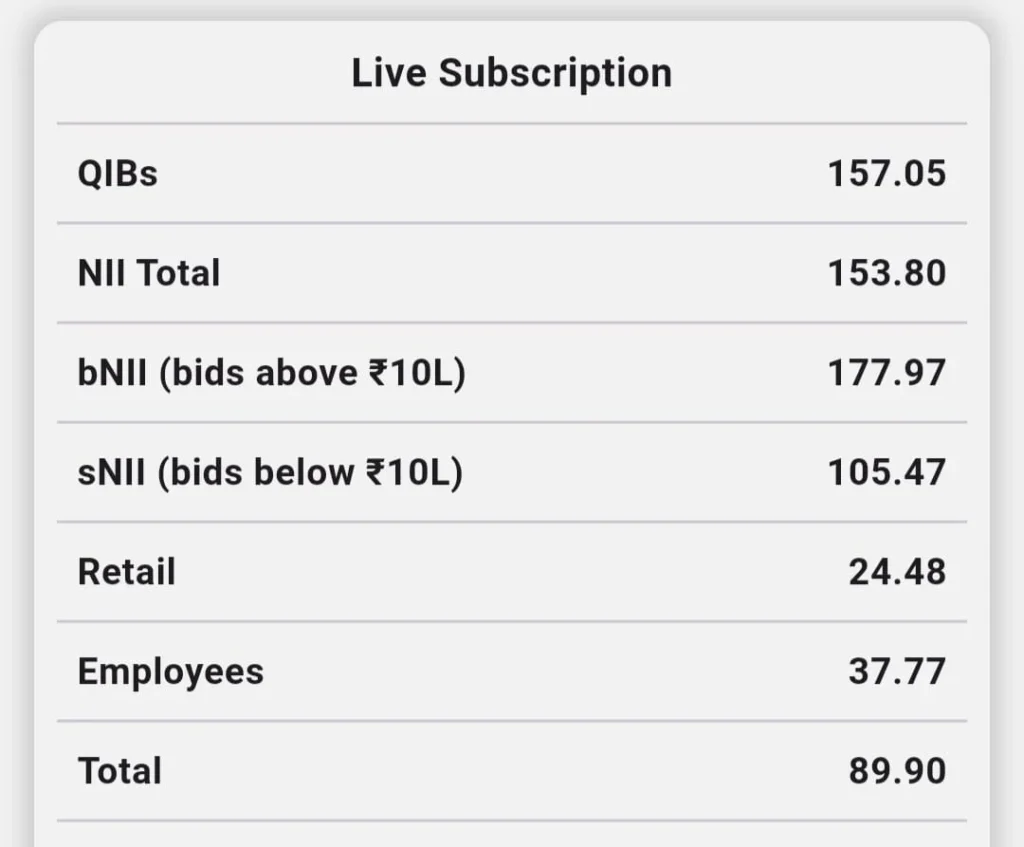

Investors had to apply for a minimum of 101 shares per lot. - Subscription:

The IPO received an overwhelming response with a subscription rate of 89.90 times, indicating strong demand among retail, HNI, and institutional investors. - Grey Market Premium (GMP):

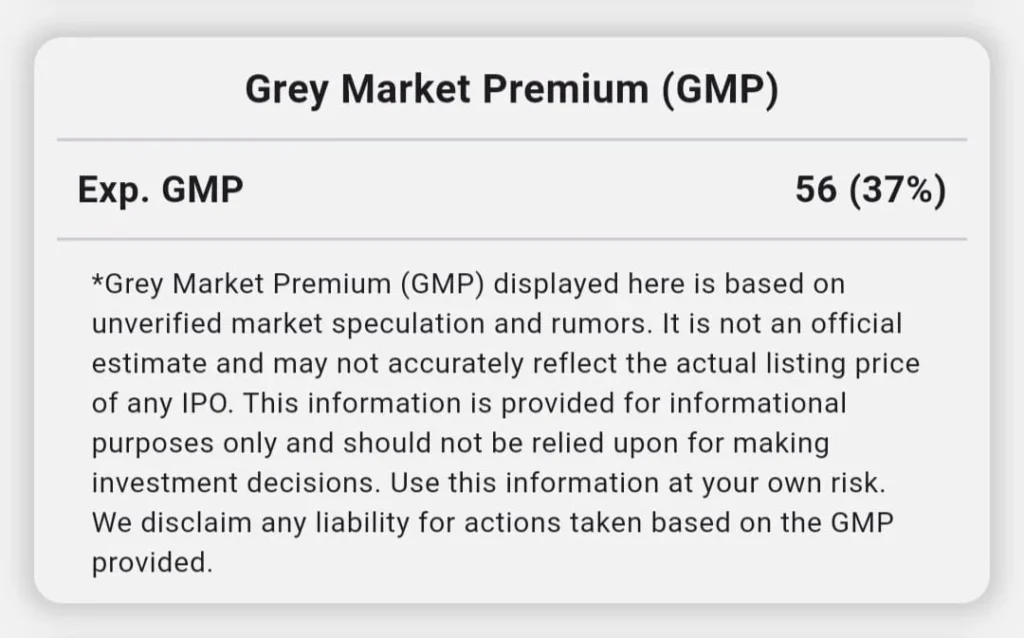

As of now, the GMP for Enviro Infra Engineers IPO stands at ₹56, translating to an attractive 37% premium over the upper price band of ₹148. This suggests positive sentiment in the unlisted market.

Allotment Status

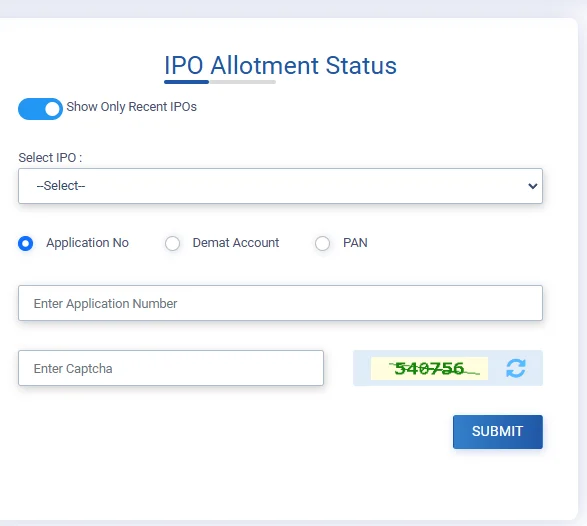

Currently, the status for IPO allotment is marked as “Waiting.” Investors eagerly anticipate the allotment announcement, which will determine their chances of receiving shares in this oversubscribed offering.

How to Check Allotment Status:

Once the allotment is finalized, investors can check their status through the following methods:

- Registrar’s Website:

Visit the official website of the IPO registrar. Enter your PAN, application number, or DP/Client ID to verify your allotment. Kfintect - Stock Exchange Website:

Log on to the NSE or BSE website to access the allotment details using similar credentials.

Post-Allotment Steps:

For those allotted shares:

- Shares will be credited to your Demat account before the listing date.

- Listing is expected to see strong action due to the GMP premium and market enthusiasm.

For those not allotted shares:

- The refund process will be initiated promptly, and the amount will be credited to the linked bank account.

Important dates:

The IPO of Enviro Infra Engineers Limited follows a detailed timeline, providing clarity for investors. The IPO opened for subscription on Friday, November 22, 2024, and closed on Tuesday, November 26, 2024. The allotment date is scheduled for Wednesday, November 27, 2024, with refunds initiated on the same day. Successful applicants can expect the shares to be credited to their Demat accounts by Thursday, November 28, 2024. The eagerly anticipated listing on the stock exchanges is set for Friday, November 29, 2024, marking the culmination of the IPO process

Final Takeaway:

The IPO of Enviro Infra Engineers Limited has shown strong market traction, reflected in the high subscription rate and substantial GMP. Investors are advised to monitor the allotment process closely and prepare for potential listing gains. With its solid fundamentals and positive market buzz, this IPO is a promising opportunity for participants.

Stay tuned for updates on Enviro Infra Engineers IPO allotment status and listing details!

Hi, I’m Avishek, a passionate stock market enthusiast turned full-time investor. With my 3+ years of experience in the Indian and Global markets, I’ve developed a keen eye for potential winners. My portfolio includes successful allotments in IPOs from NYKAA, Bajaj Housing Finance, Waaree Energies Ltd, and more. I have never lost money in the stock market. Through this blog, I will provide all the information here.