Summary: Pre IPOs are Trax Retail, Delphix, Outreach, MasterClass, ThoughtSpot. The minimum investment in these 5 companies is $10, Current price from $12.69 to $63. Exploring all details with a depth comparison in this post.

What is Pre IPO?

Mainboard IPO or Initial Public Offering means the shares are available to apply for buying when a company goes to public. And the IPO Shares are now publicly traded in exchanges. Investment horizon 5 to 8 days (from the last applying date to the listing date)

But Pre IPO is a little bit different from IPO. It is a growing secondary market shares of companies which plan to go to public and investment horizon is 12 months to 24 months. And they are not traded in the exchange now.

Benefits and risks

| Benefits | Risks |

| Investment in potential for significant returns if the company goes public with a higher valuation. | Difficult to get buyers when investors want to sell |

| Early access of the investors in the potentially successful companies. | Any changes in regulations or laws may negatively impact the company’s valuation and lead it to shut down. |

| Investment is often at lower valuation compared to publicly traded ones. | Competition with listed companies can lead to failure. |

| Minimum investment with just ₹10. After IPO announcement the minimum investment amount goes to $200 (approx.) | Unrealistic valuation sometimes leads to unsatisfactory return. |

| Generally provides diversification benefits, reducing dependency on publicly traded IPOs. | Lack of transparency. And Lock-up period. |

| Early access may have more influence and control over the company when investment amount is significant. | Analysis may not track all the criterion that leads to poor investment decisions. |

Here are best 5 Pre-IPO companies’ details

| Companies | Current Price | Minimum Investment | Earliest Start |

| Trax Retail | ₹63 | ₹10 | Any time |

| Outreach | ₹33.68 | ₹10 | Any time |

| MasterClass | ₹38.60 | ₹10 | Any time |

| Thought Spot | ₹25 | ₹10 | 1st January started |

| Delphix | ₹12.69 | ₹10 | Any time |

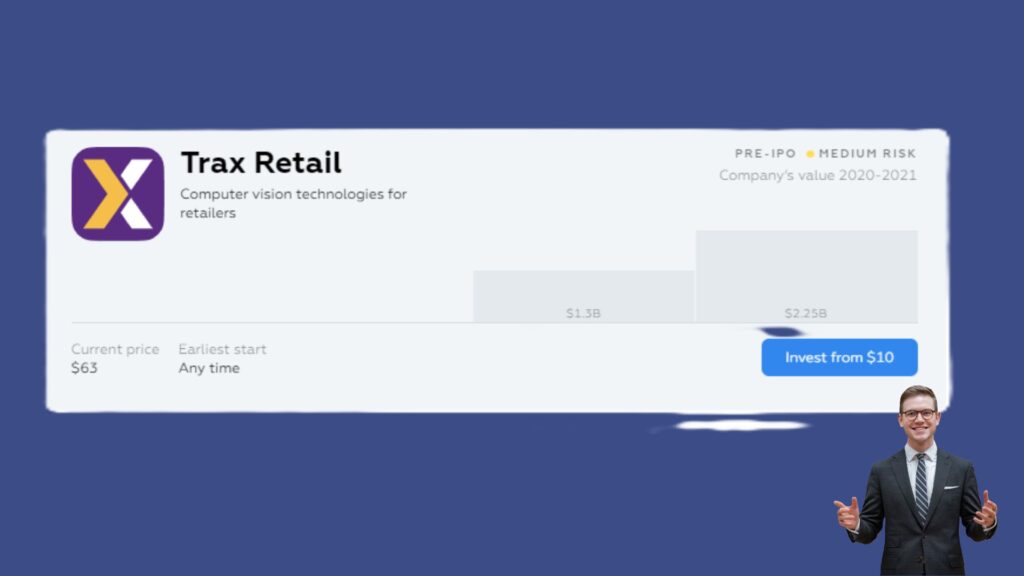

1st Company details:

Name: Trax Retail. Risk: Medium

Fee: Entry: 3.50%, Leave: 0.50%, success: 20%

Sector: Computer vision technology for retailers.

Company income: CAGR is 17%. Present valuation: $2.25B

Company Overview:

Founded in 2010 is Singapore. Company focuses on advanced computer vision for the retail industries and dominates its segment. Its major clients are ‘Best Buy’, ‘Auchan, Coca-Cola, P&G, Nestle, Unilever, Bayer, Shell, Sanofi.

Products and services:

It offers machine learning, mobile app connected store-installed camera for merchandise scanning, technology to track sales, optimize products according to customers’ preferences, predict future demands of the products, Etc.

Achievement:

The company was recognized as one of the fastest growing AI technology companies by Deloitte Technology. It holds 23+ patents in this field.

Global Presence: The company operates hubs in major cities worldwide, including Moscow.

2nd Company:

Name: Outreach. Risk: Medium.

Fee: Entry: 3.50%, Leave: 0.50%, success: 20%

Sector: Sales engagement Platform

Company income: CAGR is 11%. Present valuation: $4.44B

Overview:

Outreach founded in 2014. It focuses on enhancing sales engagement and productivity.

Venture investors are Salesforce, Steadfast Capital, Sequoia Capital, Tiger Global Management, Lone Pine Capital, Sands Capital, Mayfield Fund, DFJ Growth, Trinity Venture.

Product and services:

Outreach utilizes AI and the world’s largest customer interaction database. It automates contacts through emails, voice, and social media. It has more than a traditional CRM, and translates data into effective marketing strategies.

The company was recognized as the world’s top sales engagement platform. It has the largest customer base and industry leading usage. Clients are Adobe, Tableau, Splunk, DocuSign, SAP.

The company ranks as the 58th fastest growing vendor in its category on the Deloitte technology.

Global Presence: Seattle, San Francisco in USA. London and Prague.

3rd Company Details

Name: MasterClass. Risk : Medium

Fee: Entry: 3.50%, Leave: 0.50%, success: 20%

Sector: Celebrity taught online courses.

Company income: CAGR is 8.5%. Present valuation: $400M

MasterClass Overview:

The company was founded in 2015. It is a streaming platform offering training courses from renowned athletes and celebrities experts.

Mission: Providing experts’ guidance

Challenges: High competition with Udemy, Coursera, Udacity.

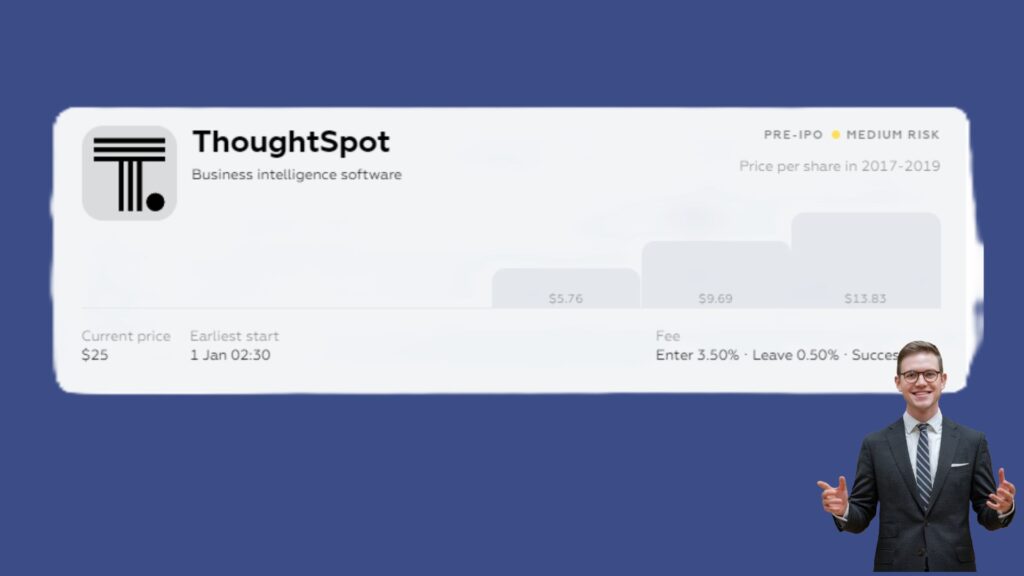

4th Company Thought Spot

Name: Thought Spot. Risk: Meduim

Fee: Entry: 3.50%, Leave: 0.50%, success: 20%

Sector: Celebrity taught online courses.

Company Financials: CAGR is 13.5%. Present valuation: $13.83B

ThoughtSpot Overview:

A big data analytics and business intelligence platform was co-founded in 2012. The company helps users explore, analyze, and share real-time business analytics data. It connects to the cloud, big data or desktop.

Customers are Walmart, BT, Hulu, Daimler, 7-Eleven, Petco, Rolls Royce.

Location

The company is based in Palo Alto, California, with 14 offices globally.

5th Company (Delphix) Details

Name: Delphix. Risk: Medium

Fee: Entry: 3.50%, Leave: 0.50%, success: 20%

Sector: Intelligent data platform

Company Financials: CAGR is 13.5%. Present valuation: $1200BM

The data platform company was founded in 2008.

Clients are Facebook, Fastweb, Vertex, Gain Capital, Vodafone, BECU, Allstate.

How to invest in Pre-IPO online?

In a simple way anyone can start investing these Pre listed IPOs.

Step-1 Visit unitedtraders dot com official site

Step-2 Create your account

Step-3 Add funds

Step-4 Invest in companies.

Disclaimer: Invest in Stocks/IPOs is subject to market risk so always invest at your own risk and analysis. The information written above is just for educational and informational purposes. It is not any recommendation or suggestion for investment.

Hi, I’m Avishek, a passionate stock market enthusiast turned full-time investor. With my 3+ years of experience in the Indian and Global markets, I’ve developed a keen eye for potential winners. My portfolio includes successful allotments in IPOs from NYKAA, Bajaj Housing Finance, Waaree Energies Ltd, and more. I have never lost money in the stock market. Through this blog, I will provide all the information here.