Summary: How to check IPO allotment status online (Garuda Construction and Engineering IPO) in a few simple steps with either gmpipo.com or Link intime official website.

Step 1: Either Visit gmpipo.com or Registrar’s official website (Link Intime)

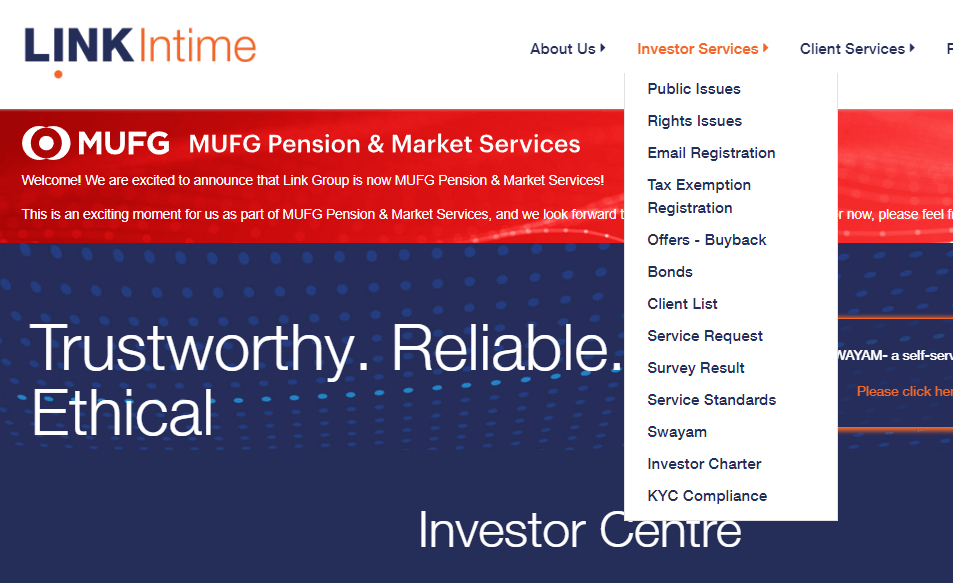

Step 2: On gmpipo.com, click on Check Allotment button or ‘Investor Services’>’Public Issue’ on Link intime

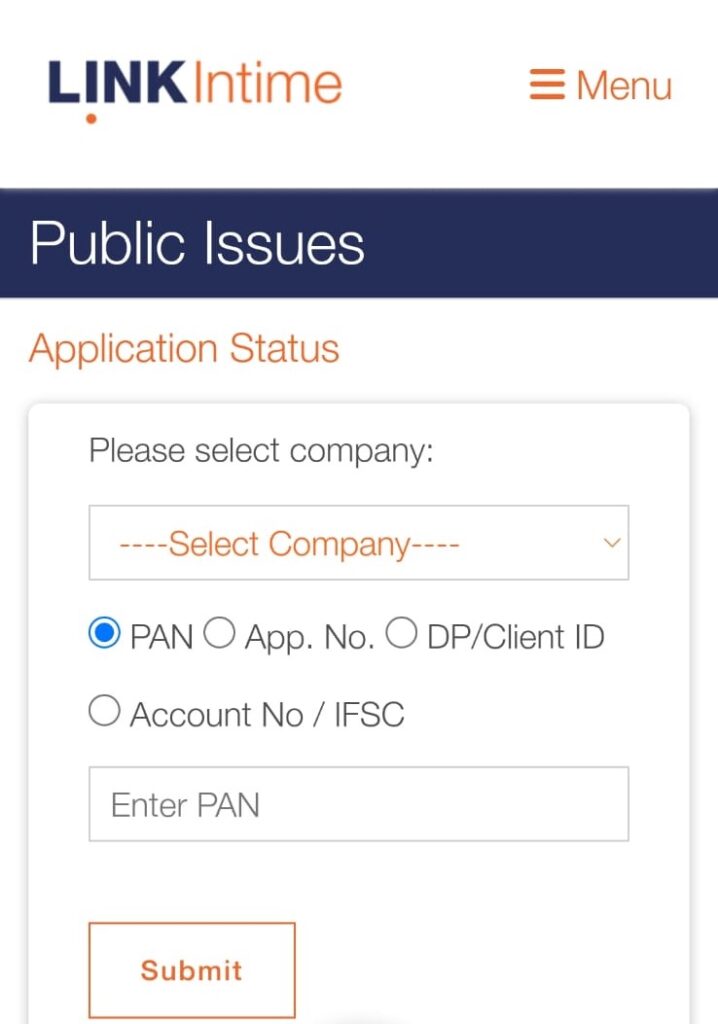

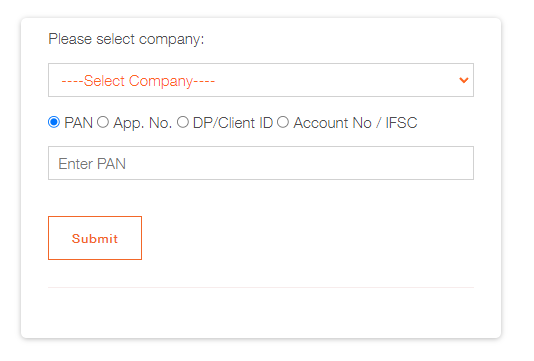

Step-3: Select company , Enter PAN no/ Application no/DP ID/Account No (Any one of them) and Submit

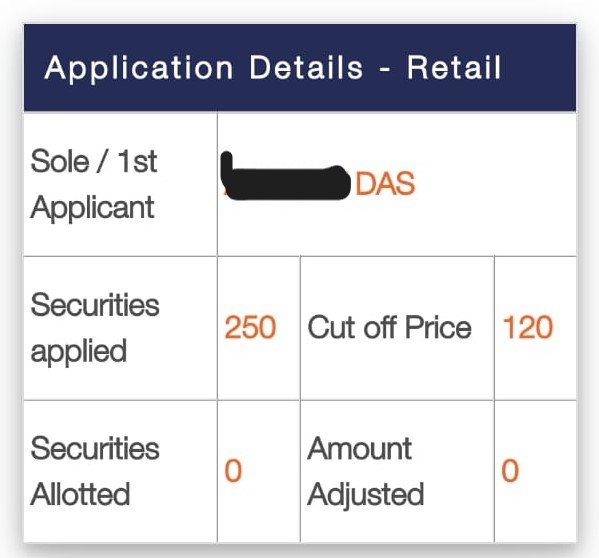

Step-4: See whether you are a allotee or not

Check Latest GMP of IPO

New Mainboard IPO Garuda construction and Engineering closes on October 10, 2024 and Allotment is scheduled on the next day, 11th October 2024.

How to check IPO allotment status

- Either Visit gmpipo.com

- Or visit Link Intime Official Website

How to check Garuda IPO through gmpipo.com

This the easiest way to check IPO allotment status. Let’s see how to check

Step-1 Visit GMPIPO.COM and you find Garuda IPO details box just on the screen and click on ‘Check Allotment’ Green colored button

Step-2 As soon as you click on the button, it will redirect to the Registrar’s IPO allotment checking page.

Step-3 Click on the ‘Select Company’ drop down and select Garuda Construction and Engineering IPO

Step-4 Choose any one ‘PAN’ or ‘Application Number’ or Client ID’, or IFC

Step-5 Enter the unique number in the box

And submit .

If you are not allotted such pop up appears

Just it. And you can check your IPO allotment status in a jiffy.

How to check Garuda IPO through Registrar

In the case of Garuda Construction and Engineering IPO, Registrar is Link Intime. So, visit Linkintime(.)co.in

step-1 Click on ‘Investor Services’ tab

Step-2 Click on ‘Public Issue’

Step-3 Select company, Enter PAN/Application No/DP ID/Account No and click on ‘Submit’

Disclaimer: All the information written above is for educational purpose and informational purpose only. This not any recommendation to invest in share market. invest in the stock market is subject to market risk and investor may lose money. So, before investing in share market consult with financial advisor and invest at your own risk and analysis.

Hi, I’m Avishek, a passionate stock market enthusiast turned full-time investor. With my 3+ years of experience in the Indian and Global markets, I’ve developed a keen eye for potential winners. My portfolio includes successful allotments in IPOs from NYKAA, Bajaj Housing Finance, Waaree Energies Ltd, and more. I have never lost money in the stock market. Through this blog, I will provide all the information here.