NSDL IPO Review: National Securities Depository Limited (NSDL) is gearing up for its much-anticipated Initial Public Offering, NSDL IPO,. With a strong presence in India’s financial ecosystem, NSDL plays a critical role in maintaining securities in dematerialized form. This NSDL IPO review focuses on key highlights of the every minute details shedding light on all aspects investors should consider.

The National Securities Depository Limited (NSDL) is India’s leading depository, managing millions of investor accounts and day-to-day securities transactions. The organization was established in 1996 to ensure the safety of handling the financial assets and processing the smooth transaction process. It is an essential player in the securities market, making the IPO particularly significant.

NSDL isn’t a debt-free company. Total Debt [2023] is ₹2,40,500 Crore and Equity [2023] ₹44,58500 Crore as per the company’s Red Herring Prospectus. So, the Debt-to-equity ratio is 0.0539

Besides NSDL, 6 more companies are bringing their IPO.

NSDL IPO Review details:

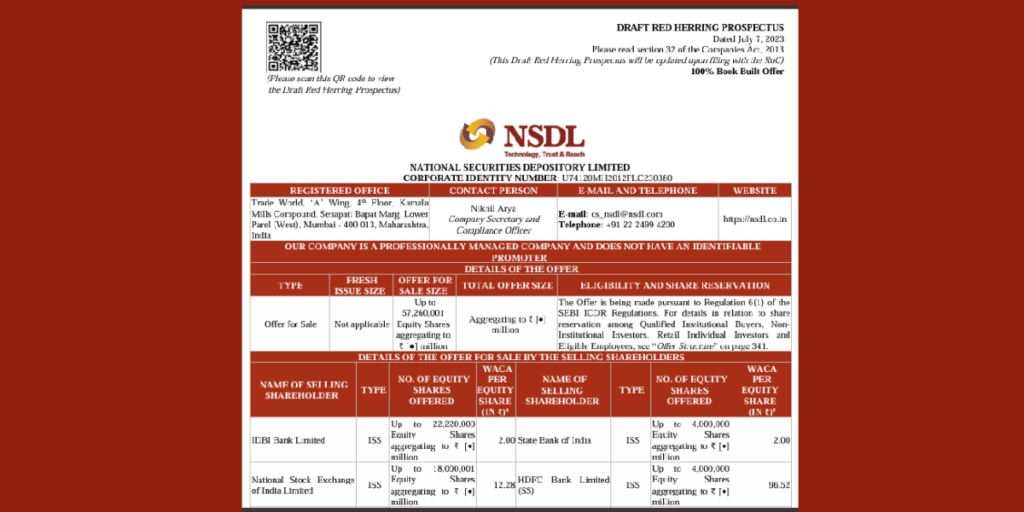

The NSDL IPO aims to raise funds to expand its operations, enhance its technology, and improve its service portfolio. NSDL IPO type is only Offer for Sale (OFS) and not any Fresh Issues. The offer for-sale size is aggregating up to 57, 260,001 million equity shares.

The price range and final offer price will be decided by the company and the selling shareholders, in consultation with the Book-running Lead Managers (BRLMs), based on the evaluation of market demand for the equity shares.

GMP of NSDL IPO

There is no grey market demand now. Check here GMP IPO NSDL

NSDL IPO Overview:

- IPO Type: Only OFS of 57.26 million Equity shares.

- Face Value: ₹2/share

- Selling Shareholders:

1) IDBI Bank Ltd sells 22.22 million shares. - 2) The National Stock Exchange (NSE) sells 18 million shares.

- 3) Union Bank of India (UBI) sells 5.63 million shares.

- 4) State Bank of India (SBI) sells 4 million shares.

- 5) HDFC Bank LTD sells approximately 4 million shares.

- 6) SUUTI sells approximately 3.41 shares.

Offer Price Band: To be announced soon

Offer Dates: To be announced soon

Lot Size: To be announced soon

Registrar: Link Intime Private Limited

The purpose of the offer is to:

1] Selling up to 57,260,001 equity shares, amounting to ₹11,452,000.2 Crore.

2] Getting the Company’s shares listed on BSE (Bombay Stock Exchange)

NSDL also believes that the listing shares will increase its visibility and brand recognition while giving people a chance to buy and sell its shares publicly in the Indian Stock Market.

The company will not receive any funds from this offer. All proceeds (after deducting the offer for sale-related expenses to be covered by selling shareholders) will go to the selling shareholders, distributed based on the number of shares each selling shareholder sells in this offer.

NSDL IPO Book Runnign Lead Managers:

- ICICI Securities Limited

- Axis Capital Limited

- HSBC Securities and Capital Markets (India) Private Limited

- IDBI Capital Markets and Securities Limited

- Motilal Oswal Investment Advisory Limited

- SBI Capital Markets Limited

Comparison with the listed industry peers and accounting ratios:

| NSDL | CDSL |

| The Face Value of ₹2 per Equity share | The Face value of ₹10 per Equity share |

| To be coming soon | Market Cap: ₹32,290.50 Crore |

| Total Income ₹1,099.814 Crore | Total Income ₹620.935 Crore |

| Basic & Diluted EPS ₹11.74 | Basic and diluted EPS ₹26.41 |

| NAV of ₹71.44 | NAV of ₹120.30 |

| RoNW 16.43% | RoNW 21.95% |

| Net Worth ₹1428.861 Crore | Net Worth ₹1257.137 Crore |

| PAT 234.81 Crore (21.35%) | PAT 275.96 |

| ROE: 16.43% | ROE: 28.60% |

| Dividend: N/A | Dividend: 0.70% |

| NSDL isn’t a deb-free company | Debt Free Company |

The Depository Act of 1996 was introduced to regulate depositories dealing with securities and related matters. Following its enactment, India’s first depository, the National Securities Depository Limited (NSDL), was established, leading the way in the dematerialization of securities in November 1996.

Notably, NSDL was among the first few global depositories to implement direct dematerialization, skipping the conventional two-step process of immobilization followed by dematerialization. When it started in November 1996, NSDL had three participants and five securities eligible for dematerialization.

Currently, India has 2 depositories: NSDl and Central Depository Services Limited (CDSL), with CDSL being established in 1999.

NSDL IPO Review Conclusion:

In the NSDL IPO review conclusion, let’s see all the details in brief. The NSDL IPO presents a unique opportunity for investors to participate in a company that plays a critical role in India’s financial infrastructure. As the leading and the first depository, NSDL’s strong market position, coupled with its consistent financial performance, makes it an attractive investment option.

The company’s low debt-to-equity ratio of 5.4 reflects a healthy balance sheet. Besides, the ROE of the NSDL is 16.43% which is near 20% and indicates positiveness. And rest of the factors indicate further enhancement of the investors’ confidence.

However, potential investors consider the market risks and regulatory changes. Overall, NSDL IPO offers promising prospects, backed by its technological advancements and plans for growth, making it a valuable addition to any portfolio.

We hope better information has been shared in this NSDL IPO Review.

Hi, I’m Avishek, a passionate stock market enthusiast turned full-time investor. With my 3+ years of experience in the Indian and Global markets, I’ve developed a keen eye for potential winners. My portfolio includes successful allotments in IPOs from NYKAA, Bajaj Housing Finance, Waaree Energies Ltd, and more. I have never lost money in the stock market. Through this blog, I will provide all the information here.