NVIDIA Stock Price Prediction for 2025, 2030, and up to 2040 will highlight whether NVIDIA maintains continuous and steady growth! All future updates regarding NVIDIA Stock will be available in this post so that NVIDIA Stock Price Prediction gets a new horizon daily. Please save this page.

🎁NVIDIA Earnings Forecast Alert: Morgan Stanley forecasts $6 Billion in sales for NVDA's Blackwell microchip in Q3. It will help rising price target to $160 in short-term and reiterating BUY rating.✔️

📢Do you know?

😎Piper Sandler named NVIDIA a top pick. He raised price target to $175, citing strong demand for AI accelerators and upcoming Blackwell chip launch.

NVIDIA Shares Price: $148.29

Technology sector based, NVIDIA Shares last tarded price is $148.29 (12 November). According to NASDAQ, NVIDIA is up by 1.61%. NVIDIA’s latest P/E ratio is 19.64. Its earnings per Share (EPS) is $7.58.

Key Events for NVIDIA Stock Price Prediction

NVDA Shares are boosted by strong demand & analyst upgrades on 12 November

NVDA is experiencing a significant stock momentum. The momentum is driven by strong demand for its AI chips and positive analysts’ forecasts.

Mizuho and Morgan Stanley have raised price targets. It reflects bullish sentiments.

The company’s upcoming earnings report is highly anticipated with expectations of robust sales from its new ‘Blackwell microchip’.

Overall, NVDA’s growth potential in the AI sector continues to attract investor interest.

Nvidia Gains Piper Sandler Support on 11 November 2024

Piper Sandler recognized Nvidia as a top pick with a price target increase of $175. Siemens integrates Nvidia’s GPUs into new industrial PCs, enhancing its AI capabilities. However, skepticism from the fund manager Terry Smith raises concerns about future growth amidst rising competition and market volatility.

Nvidia Reaches New Highs Ahead of Earnings on 8 November 2024

Nvidia Stocks have surged to an all-time high. It even surpassed ‘Apple’ in market cap. Goldman Sachs maintains a ‘BUY’ rating. Goldman Sachs anticipated a strong earnings performance ahead.

Nvidia Achieves Record High Amid AI Advancement on 7 Nov 2024

NVIDIA Stocks reached a record high of $3.65 Trillion. It has been driven by strong investors’ sentiments following Trump’s election. The Company also appointed Ellen Ochoa to its board and it reported significant advancements in AI & Robotics. It indicates continued growth potential.

👍If NVIDIA's Stock price continues to grow at an annual rate of 99.45%, based on its 5-year return, the price could rise from $279 to $300 by the end of 2025. Check: Top 50 Dividend Aristocrats

You May Also Like:

👉AbbVie Inc. Stock Prediction 2025

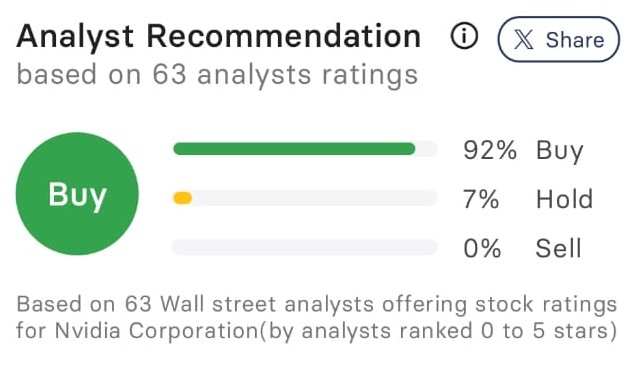

NVIDIA (NASDAQ: NVDA) has been one of the most popular tech-sector-based US stocks in recent years. International investors keep NVIDIA stocks always on their radar. The company is driven by its dominance in Artificial Intelligence (AI), graphics processing units (GPUs), and online gaming. With 63 stock market analysts predicting that NVIDIA’s stocks grow substantially by 2025 and between 2025 and 2040, investors are asking what will be the NVIDIA stock price prediction for 2030 and up to 2024. Is NVIDIA stock a good investment for the long term? What factors will shape its price target and why are experts hopeful about this tech sector stock?

Let’s explore NVIDIA’s growth drivers, current stock performance, short-term profit potentiality, long-term profit potentiality, and global stock market expert predictions for the stock price in 2025, and up to 2024. Whether you’re a seasoned investor or a beginner in stock investing, understanding NVIDIA’s future growth is key to making informed decisions. Now dive into the NVIDIA Stock Price Prediction discussion.

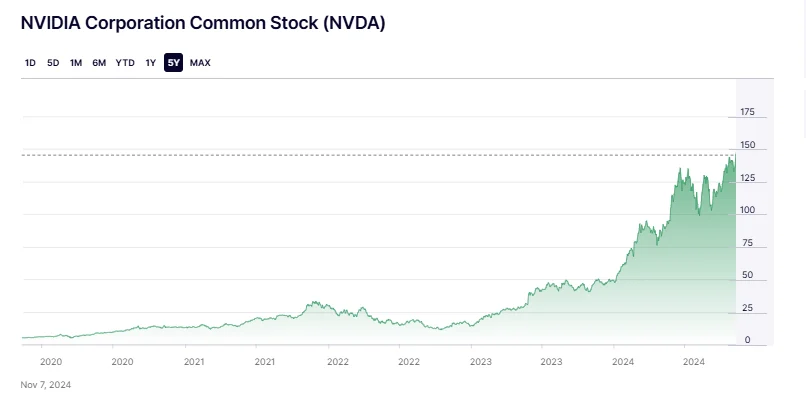

NVIDIA Stock Returns Summary:

- 1 Week returns: +1.92%

- 1 Month returns: +15.4%

- 3 Months returns: +22.0%

- 6 Months returns: +75.21%

- 1 Yesr returns: +219.57%

- 3 years returns: +502.79%

- 5 years returns: +2736.44%

These figures highlighted strong, sustainable growth, especially over the longer term, with NVIDIA’s stock returning 2019.57% over the last year alone and an incredible 2736.44% over 5 years.

Here is your favourite TESLA Stock Prediction 2025-2030

You may also like Top 50 Dividend Aristocrats

NVIDIA Stock Price Prediction 2025 to 2030

Assuming the price continues to rise exponentially like the past 5 years and based on historical growth patterns (like the 99.45% annual growth used earlier)

$139.56 * (1 + 0.9945) = $278

$278 * (1 + 0.9945) = $554

$554 * (1 + 0.9945)= $1,105

$1,105 * (1 + 0.9945) = $2,203

$2,203 * (1 + 0.9945) = $4,392

$4,392 * (1 + 0.9945) = $8,754

However, this NVIDIA stock price prediction may not be feasible. So, considering the market volatility, company market cap, competition, financials, and volume, the following NVIDIA stock price prediction we may follow.

| Year | NVIDIA Stock Price Prediction |

| 2025 | Estimating around $175 to $220 with continuous growth |

| 2026 | Estimating around $225 to $235 based on the same compounding effect |

| 2027 | $235 to $275 |

| 2028 | $280 to $305 |

| 2029 | $310 to $350 |

| 2030 | $375 to $400 |

| 2031 | $400 to $450 |

| 2032 | $455 to $465 |

| 2033 | $470 to $495 |

| 2034 | $500 to $515 |

| 2035 | $510 to $530 |

| 2036 | $539 to $569 |

| 2037 | $575 to $600 |

| 2038 | $605 to $634 |

| 2039 | $629 to $650 |

| 2040 | $655 to $700 |

NVIDIA Fundamentals:

- Average market capital: $3.53T

- PE Ratio: 67.41

- Enterprise Value: $3.5T

- PB Ratio: 60.62

- Total Assets: $65.7B

- Revenue FY2024: $60.9B

- Profit FY24: 44.3B

- Net Income FY24: 29.8B

- 52 Week High: $144.42

- 52 Week Low: $39.23

NVIDIA analysts rating: 93.55% Buy

- Buy: 93.55%

- Hold: 6.45%

- Sell: 0.00%

NVIDIA is currently valued at 67.41 times its earnings, which is much higher than the industry average of 34.42./ This suggests the market is optimistic about NVIDIA’s future growth. Its current P/E ratio is also much higher than its historical low (13.54) but lower than its all-time high (192.14)

First, let’s make out NVIDIA’s Current Market Position

As of 20 October 2024, NVIDIA stock is trading at approximately between $139 and $142 per share, with a market cap of $3.5 Trillion. Its impressive rise has been fueled by breakthroughs in AI, gaming, and data centers. In the recent past, the company has experienced a very positive sentiment with a surged last-traded price (LTP). Goldman Sachs has already set the NVIDIA Stock Price Target to $150. Investor A.J. Button advises caution, suggesting a buy-target of $83 due to the anticipated growth declaration. Additionally, NVIDIA is highlighting its generative AI applications in health care at the HLTH conference, further showcasing its innovative motives and capabilities

Second, NVIDIA Stock Surges on 21 October

NVIDIA shares have soared to record highs, driven by strong demand for AI chips and the innovative introduction of a new AI model.

Stock market expert analysts have raised price targets as well as reiterated buy ratings, highlighting NVIDIA’s potential for significant cash flow. The company’s market cap reaches $3.4 trillion, reflecting its dominance in the AI sector.

Third, NVIDIA makes a new all-time high.

As of 22 October, NVIDIA stock price touches its new all-time high of $143.71, driven by strong demand for GPUs and the forthcoming Blackwell chip release.

AI stock analysts predict continuous growth, with a significant investment planned in Thailand. Investor sentiment remains bullish, heading to an upgrade to ‘Strong Buy’.

Fourth, NVIDIA Partners with Reliance for AI Infrastructure

As of 24 October, NVIDIA CEO announced a partnership with Mukesh Ambani to establish a 1 Gigawatt AI infrastructure center in Jamnagar, Gujarat India. This collaboration highlights NVIDIA’s commitment to expanding its AI capabilities in the region.

What if you invested in NVIDIA just 1, 3 & 5 years ago?

In the past 1 year, the stock market has seen explosive growth in various sectors, but few companies have experienced the meteoric rise the NVIDIA (NVDA) has. If an investor had invested in this stock 1 year ago, the investment returns would have far outpaced traditional benchmarks like S&P 500 and NASDAQ. What would this investment look like today?

Initial Investment $15.00K

- Let’s begin by imagining one invested $15 in NVIDIA 12 months ago. Based on historical performance, that investment would now be worth a staggering $47.94K, representing an incredible growth of 219.57%. Where NASDAQ and S&P 500 returns would be $20.86K and $20.47K respectively against the same investment.

- If $15.00K had been invested 3 years ago in NVIDIA, the investment would have been now $90.42K, representing a massive return of 502.79%. Whereas the NASDAQ and S&P 500 returns would be 20.03% and 26.95% respectively.

- And if $15.00K was invested in NVIDIA 5 years ago, the investment would be now worth $4.25L, representing a gruesome return of 2736.44%. Whereas NASDAQ and S&P 500 returns would be much less than NVIDIA.

What’s Next for NVIDIA?

Looking forward, NVIDIA continues to be a leader in cutting-edge technologies such as AI data centers, self-driving cars, and cloud computing. With AI revolutionizing industries and NVIDIA remaining at the forefront, analysts believe the company stocks could continue to perform well. However, as with any stock, it’s essential to consider the risks and market conditions.

Final Lines: NVIDIA Stock Price Prediction

We have already come to know had one invested $15K in NVIDIA 5 years ago, the returns would be 2736.44% now, and after 3 years the returns would be 502.79%, and if invested last year, the returns would be 219.57% now after 1 year. It’s a reflection of how this tech giant has outpaced the market by leveraging its leadership in AI gaming, and fast-growing industries. While future performance is never guaranteed.

We hope the query has been satisfied in this post NVIDIA Stock Price Prediction.

Disclaimer: All the information written above is just for educational and informational purposes. it’s not any investment recommendation. Stock market investment is subject to market risk so invest at your own risk and analysis. Any financial loss, if anyone incurs, gmpipo.com will not be considered responsible.

Hi, I’m Avishek, a passionate stock market enthusiast turned full-time investor. With my 3+ years of experience in the Indian and Global markets, I’ve developed a keen eye for potential winners. My portfolio includes successful allotments in IPOs from NYKAA, Bajaj Housing Finance, Waaree Energies Ltd, and more. I have never lost money in the stock market. Through this blog, I will provide all the information here.

3 thoughts on “NVIDIA Stock Price Prediction 2030: will AI push it to unimaginable heights? ”