Swiggy IPO: Swiggy is here with its ₹11,000 Crore Initial Public Offering. Swiggy Limited’s mainline IPO is set to be opened between 6 November and 8 November. The allotment date is 9 November. The listing’s tentative date is 12 November 2024.

📢New Mainline IPO Swiggy Limited

Swiggy Limited IPO >

Opens on 5 November 2024

Offer Date: 6 Nov to 8 Nov

Allotment Date: 9 Nov

Listing Date: 12 Nov

Offer Price: ₹371 to ₹390

Lot Size: __ Shares

IPO Document DHRP File

Latest GMP ₹-₹ (0%)

Minimum Investment: ₹14,_ _ _

Live Subscription Check Allotment

About Swiggy:

Before knowing about Swiggy IPO, it is important to know about the company. Swiggy Limited is a modern-day, customer-focused software and technology company that offers a convenient online/offline platform. It launched its first food delivery in 2014 and Quick Commerce in 2022. Users can order food, groceries, and household items through its single mobile app and its website. Users can also book restaurant tables, and access services like event bookings, and product pick-up/drop-off through its service tabs; ‘Food Delivery’, ‘Instamart’, ‘Dineout’, ‘Stepping out’, ‘Genie’, Etc. The company is well-known for its innovation and leadership in the hyperlocal commerce/e-commerce space.

It has completed 300+ Crore orders, partnerships with 300K+ restaurants, and 380K+ delivery partners. Its network covers 650+ cities across India.

Swiggy IPO Details:

| Name | Swiggy Limited |

| Sector and Industry | Internet Software & Services |

| Face Value | ₹1 |

| Issue Size | Announced soon |

| Issue Type | Fresh and OFS (Offer for Sale) |

| Fresh Issue | Equity Shares aggregating up to ₹3,750 Crore |

| Offer for Sale | Equity Shares aggregating up to 18.53 crore |

| Price Band | It’s not announced yet |

| Opens on | November or December, 2024 |

| Closes on | in 3 days from its opening in November or December 2024 |

| Lot Size | It hasn’t been announced yet |

| GMP | ₹0 |

| Registrar | Link in time Private Limited |

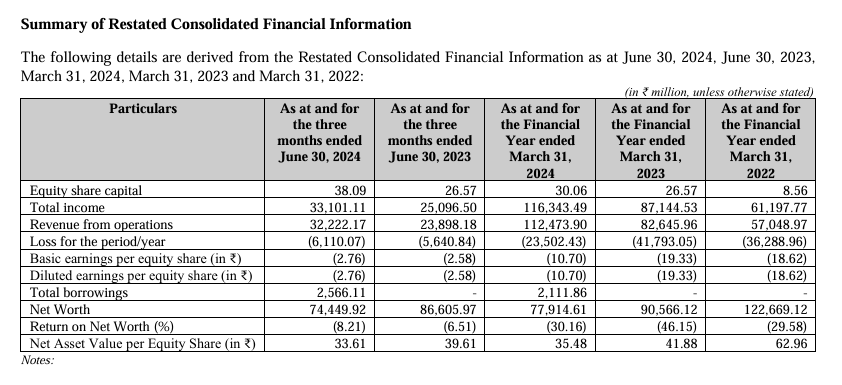

| Revenue from Operation | ₹5,195,65 Crore in Fiscal 2024 |

| Profit after tax | ₹423.97 Crore |

| IPO document | DHRP File |

| Peer | Zomato |

Swiggy Limited IPO UDRHP important data

Swiggy IPO objectives:

The net proceeds from the funds of the fresh issues will be utilized for several strategic initiatives. Primarily, investments will be made in Swiggy’s Material Subsidiary, Scootsy, to repay or pre-pay borrowings.

Additionally, funds will support the expansion of Scootsy’s Dark Store network for the quick commerce segment, including new Dark Stores and related leases and License payments.

Swiggy will also enhance its technology, cloud infrastructure, brand marketing, and business promotion. Investments will also be used for general corporate purposes.

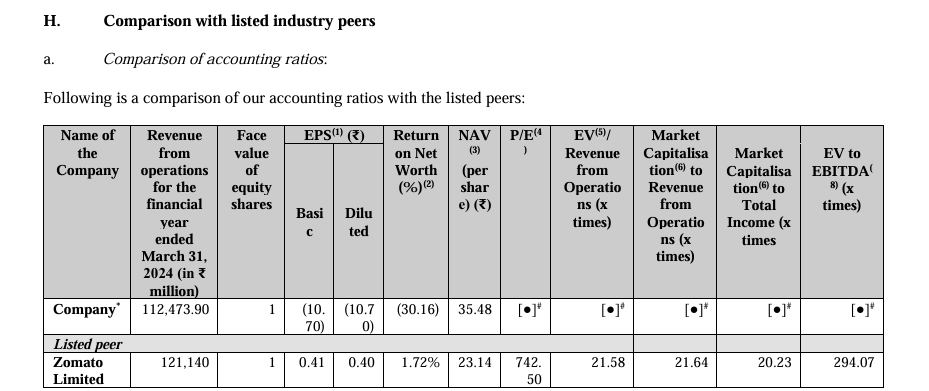

Comparison with Peer Competitor:

| Company | Swiggy | Zomato |

| Revenue | ₹11,247 Cr. | ₹12,961 Cr |

| Net Worth | __ | ₹20,406 |

| Net Profit | __ | ₹351.00 Cr. in 2024 |

| AVO | ₹428 Cr | ₹428 Cr |

| Market Capital | __ | ₹2,47,318.33 Crore. |

| Profit Margin | __ | 2.90% in 2023-2024 |

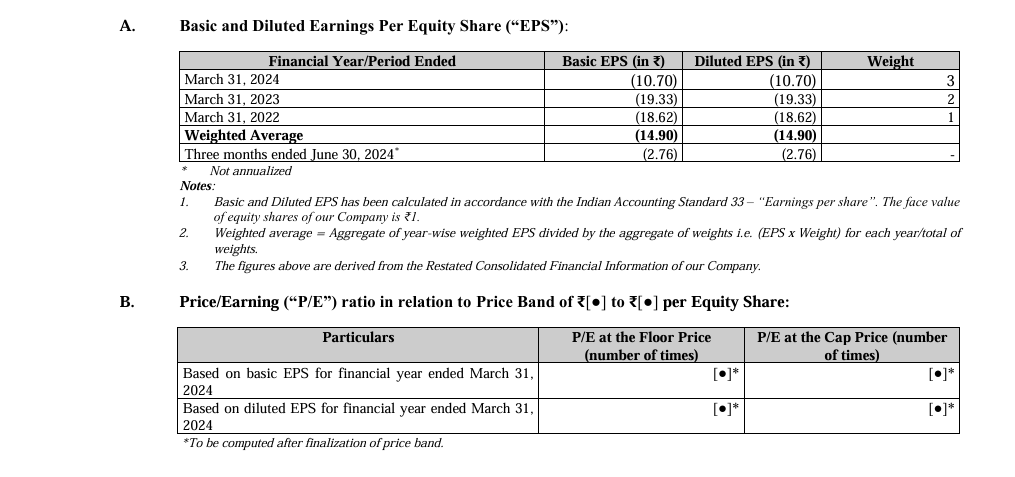

| P/E | __ | 408.02 |

| Industry P/E | 184.58 Crore. | |

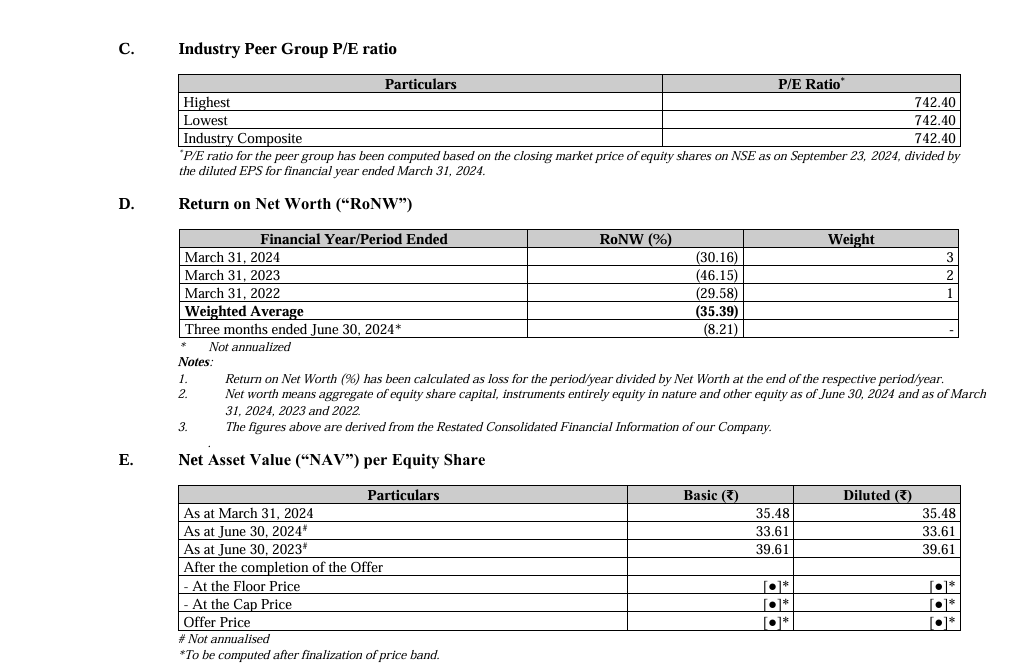

| ROE | __ | 5.15% in 2024 |

| ROCE | __ | 5.18% |

| Return on Net Worth | 8.21% | __ |

| Total Borrowing | ₹256.61 Cr. | __ |

| Price | It’s not announced yet | ₹276.70 |

Bidding dates, lot sizes, and price bands have not been announced yet. As soon as we get updates, we insert the information in our post.

All the information is taken from the company’s Red Herring Prospectus. Swiggy IPO applies should know these above-mentioned questions and answers.

Disclaimer: All the information written above is just for educational and informational purposes. it’s not any investment recommendation. Stock market investment is subject to market risk so invest at your own risk and analysis.

Hi, I’m Avishek, a passionate stock market enthusiast turned full-time investor. With my 3+ years of experience in the Indian and Global markets, I’ve developed a keen eye for potential winners. My portfolio includes successful allotments in IPOs from NYKAA, Bajaj Housing Finance, Waaree Energies Ltd, and more. I have never lost money in the stock market. Through this blog, I will provide all the information here.