Zinka Logistics IPO GMP became ₹0 (0%). On 13 November, Zinka Logistics IPO GMP percentage is 0%.

The ‘Grey Market Premium (GMP)’ indicators show the expected premium for an IPO in the grey market. The premium is projected to be between 22 and 26, which corresponds to an approximate increase of 9% over the IPO’s price during the IPO was announced.

Additionally, a disclaimer explains that the Zinka Logistics IPO GMP values are based on unverified market rumors and should not be considered official guidance or an accurate prediction of the IPO’s listing price. The purpose of the GMP data is purely informational, advising investors not to rely on it for making investment decisions. The disclaimer also emphasizes that reliance on this information is at the user’s risk, and the provider disclaims responsibility for any actions based on the provided GMP.

This Zinka Logistics IPO GMP guidance aims to help readers understand that GMP is a speculative measure, not a guarantee of the stock’s performance post-listing.

Zinka Logistics IPO GMP and other details:

Provided details on the IPO of Zinka Logistics Solution Ltd, also known as Blackbuck, which is listed on the mainboard market. Here are the key details:

- IPO Dates: The IPO is open from November 13 to November 18, 2024.

- Price Band: The share price range for the IPO is set between ₹259 and ₹273.

- Zinka Logistic GMP: The current GMP is ₹0, Previously Zinka Logistics IPO GMP indicated a GMP between 8.79%-9% over the upper price band.

- Lot Size: Investors must purchase at least 54 shares per lot.

Additional dates and profit estimates include:

- Allotment Date: Shares will be allotted on November 19, 2024

- Listing Date: The shares are expected to be listed on the stock exchange on November 21, 2024

- Estimated Profit:

1] Retail Investors: Estimated profit is around ₹1,296 per lot.

2] High Net Worth Individuals (HNIs): Estimated profit is around ₹18,144 per lot.

This information helps potential investors understand the key dates, cost, and potential profit of the IPO based on current Zinka Logistic Ltd GMP trends, giving them a sense of demand and profit potential

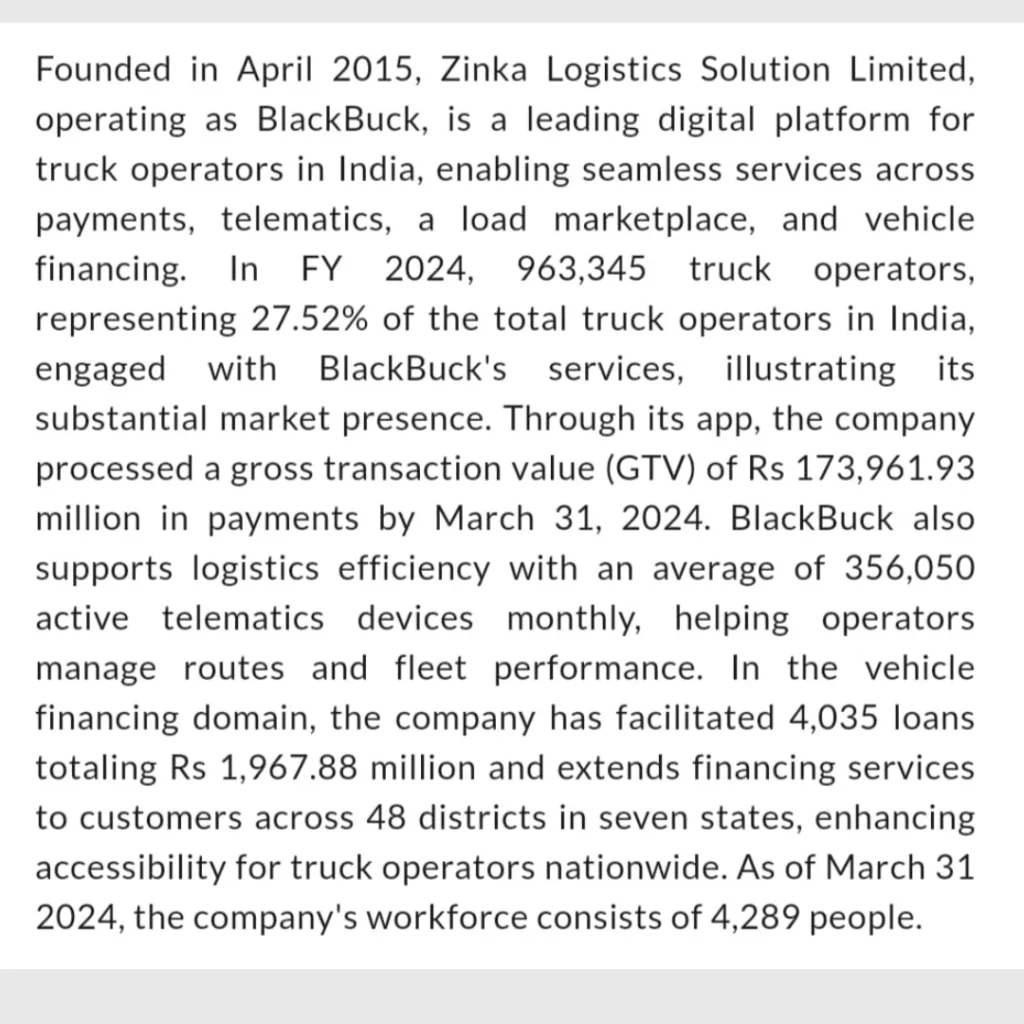

About Zinka Logistics or BlackBuck Company:

A summary of the Zinka Logistics IPO GMP or BlackBuck IPO details:

- Issue Size: The IPO consists of 40, 832, 320 equity shares, amounting to a total of ₹1,114.72 Crore.

- Fresh Issue: Out of the total 20, 146, 520 equity shares are newly issued, aggregating to ₹550.00 Crore.

- Offer for Sale (OFS): 20, 685, 800 equity shares, valued ₹564.72 Crore, are offered by existing shareholders.

Additional Zinka Logistics IPO GMP details include:

- Employment Discount: Employees receive a discount of ₹25 per share.

- Issue Type: This is a Book Buil Issue IPO, allowing bids within a specified price range.

- Listing: This IPO will be listed on both BSE and NSE exchanges.

- Shareholding:

1] Pre-Issue: 156,330,160 shares were held before the IPO. 2] Post-Issue: Post-IPO, the total shareholding will increase to 176,476,680 shares.

This breakdown offers investors insight into the structure of BlckBuck’s IPO including the division between new shares and those offered by existing holders, employee benefits, and listing details.

👉Check All IPO in One Place: GMPIPO.COM

Check NSE IPO

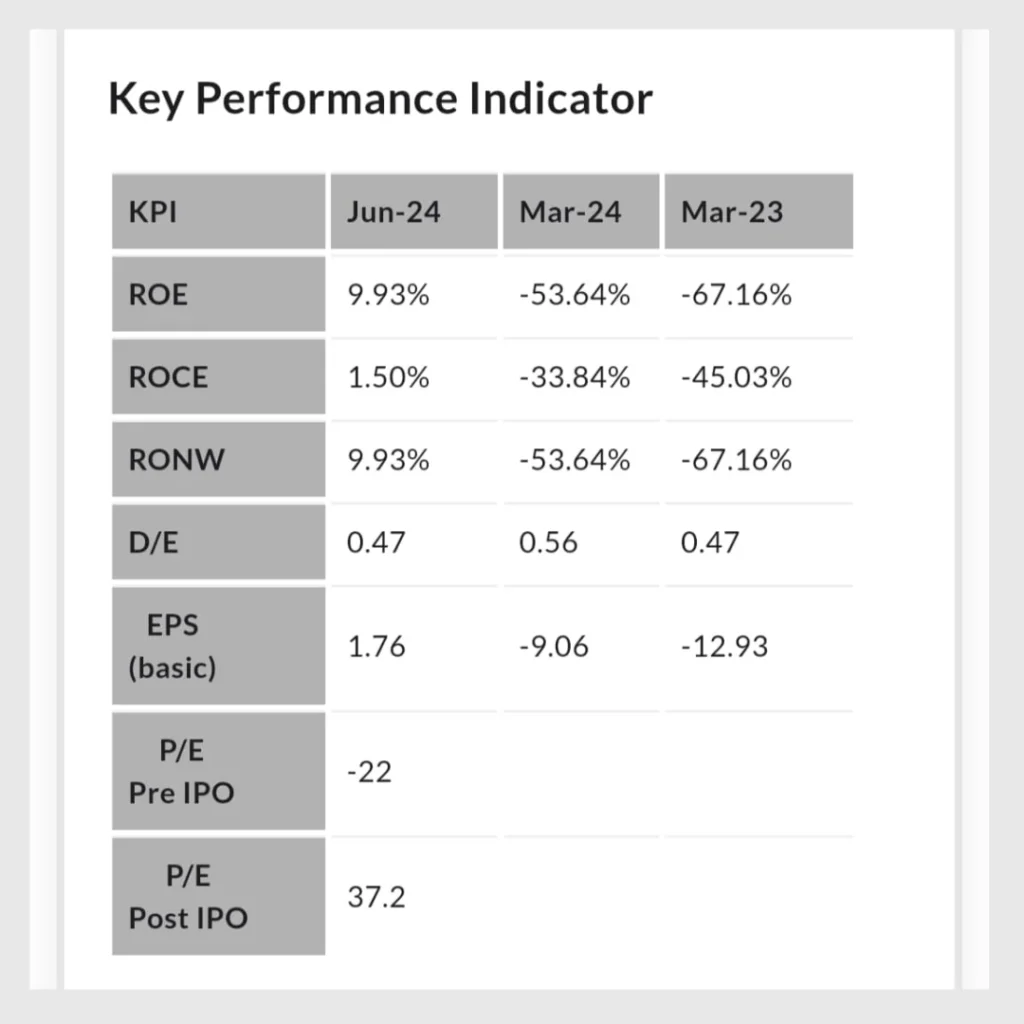

The table displays financial Key Performance Indicators (KPIs) Across three reporting periods: March 2023, March 2024, and June 2024. Here is a breakdown of each KPI with the change over time:

1] Return on Equity (/ROE) Measures the company’s profitability relative to shareholders’ equity.

-Improved from negative values in March 2023 (-67.16%) and March 2024 (-53.64%) to a positive 9.93% by June 2024, indicating a significant turnaround in profitability.

2] Return on Capital Employed (ROCE): It shows how efficiently capital is being used for profits.

It improved from (-ve) 45.03% (March 2023) and (-ve) 33.82% (March 2024) to a positive 1.50% by June 2024, suggesting the company has become more efficient in using capital.

3] Return on Net Worth (RONW): Similar to ROE, reflects returns on shareholders’ investments.

It follows the same pattern as ROE, going from (-ve) 67.16% and (-ve) 53.64% in previous periods to a positive 9.93% in June 2024.

4] Debt to Equti (D/E): It indicates the proportion of debt relative to equity.

It increased slightly from 0.47 in March 2023 to 0,56 in March 2024, before reducing back to 0.47 by June 2024, showing a more balanced approach to debt.

5] Earning Per Share (EPS- Basic): Earnings attributed to each share, are a key measure of profitability.

It increased from negative figures (-12.93 in March 2023 and -9.06 in March 2024) to a positive 1.76 in June 2024, signaling that the company is now generating profit per share.

6] Price-to-Earnings (P/E) Ratio:

Pre-IPO P/E: it was recorded as -22, likely indicating losses at the time or negative earnings before the IPO.

Post -IPO P/E: It is shown as 37.2 indicating the company’s stock valuation relative to its earnings has risen post-IPO, likely due to improved financial performance.

Overall, these indicators reflect the company has shown improvement in profitability and financial efficiency by June 2024 compared to previous periods, likely driven by operational improvements or strategic changes.

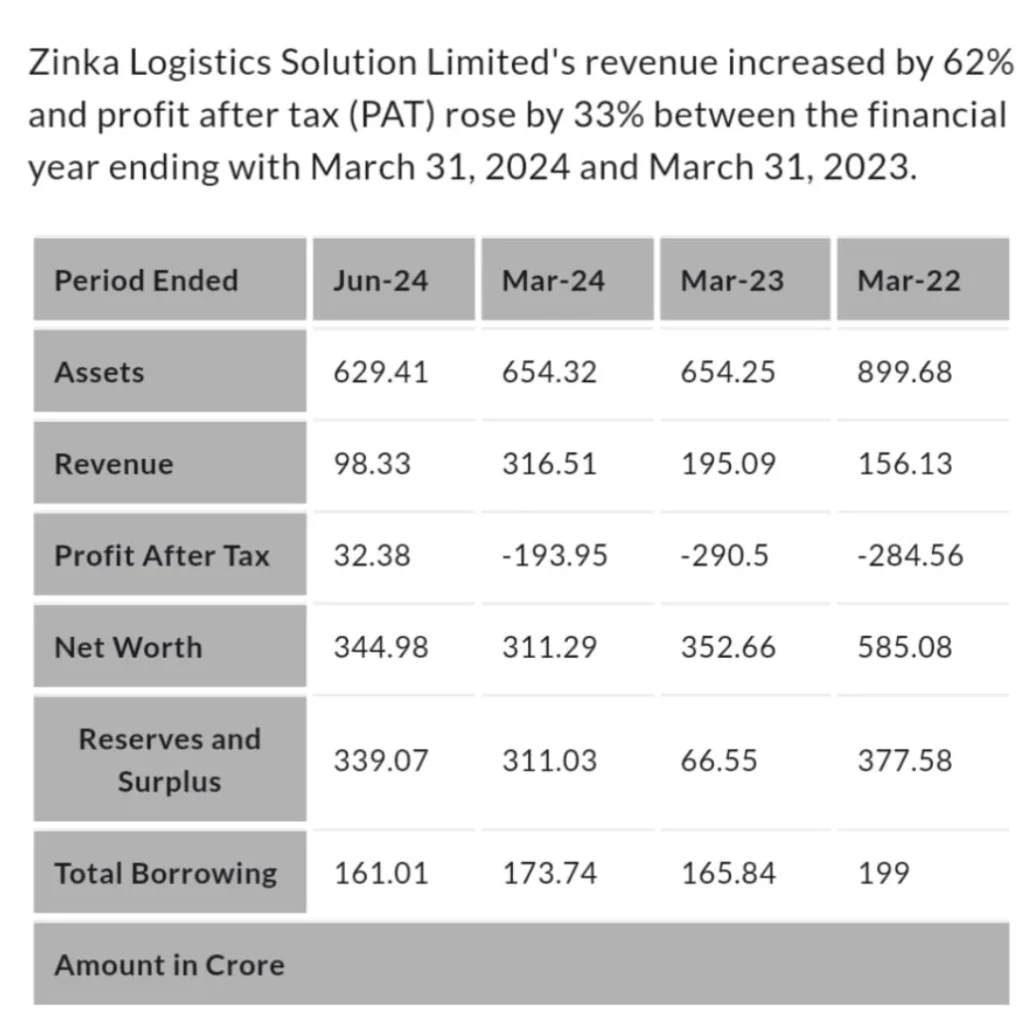

Zinka Logistics Solution Ltd Financials

Image Source: IPO Premium App.

1] Zinka Logistics Ltd IPO Registrar:

- Name: Kfin Technologies Limited

- Phone: 04067162222, 04079611000

- Email: zinka.ipo@kfintech.com

- Website: kosmic.kfintech.com/ipostatus

2] Lead managers:

- Axis Capital Limited

- Morgan Stanely India Comapny PVT LTD

- JM Financial Limited

- IIFL Securities Ltd

3] Company Address:

- Zinka Logistics Solution Limited

- Address: Vaswani Presidio, no. 84/2, II floor, Panathur Main Road, Kadubeesanahali, Off Outer Ring-Road, Bengaluru 560103

- Phone: +91 8046481828

- Website: blackbuck.com

Disclaimer: This Zinka Logistics IPO GMP data doesn't guarantee sure listing gain/loss, if allotted.

The data presented on this gmpipo.com site, including today’s GMP rate and today’s GMP price, is intended for informational purposes only. We endeavor to provide accurate and current information on the GMP of the Latest IPOs and today’s gmp to support your understanding of the latest gmp trends and market sentiments with demands. However, open IPO gmp values and current IPO GMP can fluctuate due to market ups and downs.

Please note that the GMP of current IPOs or data on current IPOs and GMP may not always reflect real-time changes. If users considering investments, doing independent research or seeking guidance from a financial professional is essential. Any actions based on this site’s latest gmp ipo information are at your own risk, and we assume no liability for potential losses.

Hi, I’m Avishek, a passionate stock market enthusiast turned full-time investor. With my 3+ years of experience in the Indian and Global markets, I’ve developed a keen eye for potential winners. My portfolio includes successful allotments in IPOs from NYKAA, Bajaj Housing Finance, Waaree Energies Ltd, and more. I have never lost money in the stock market. Through this blog, I will provide all the information here.