Today, the second day, the ongoing Waaree IPO GMP is between 90% and 95%. The Waaree IPO has been subscribed a total of 8.80 Times. Though the GMP trends are going slightly down, investors are showing interest in applying.

Waaree Energies IPO Live Subscription: till 22 October

- QIBs: 1.80 Times

- HNI total: 24.02 Times

- bNII (Bids above ₹10 Lakh): 24.29 Times

- sNII (Bids below ₹10 Lakh): 23.47 Times

- Retail: 7 Times

- Employees: 3.5 Times

- Total Subscription: 8.80 Times

Waaree Energies IPO Day 2

| GMP | Subscription status |

| ₹1,360-₹1,410 (90%-93% | 8 Times |

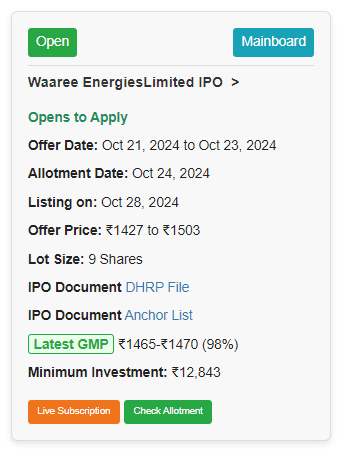

This indicates the demand for the Waaree Energies IPO, along with a handsome listing gain. The Waaree IPO offers significant details that should be considered. With a face value of ₹10 per share, the issue price is between ₹1427 and ₹1503 per share, and the lot size is 9 shares. On the very first day, it was fully subscribed.

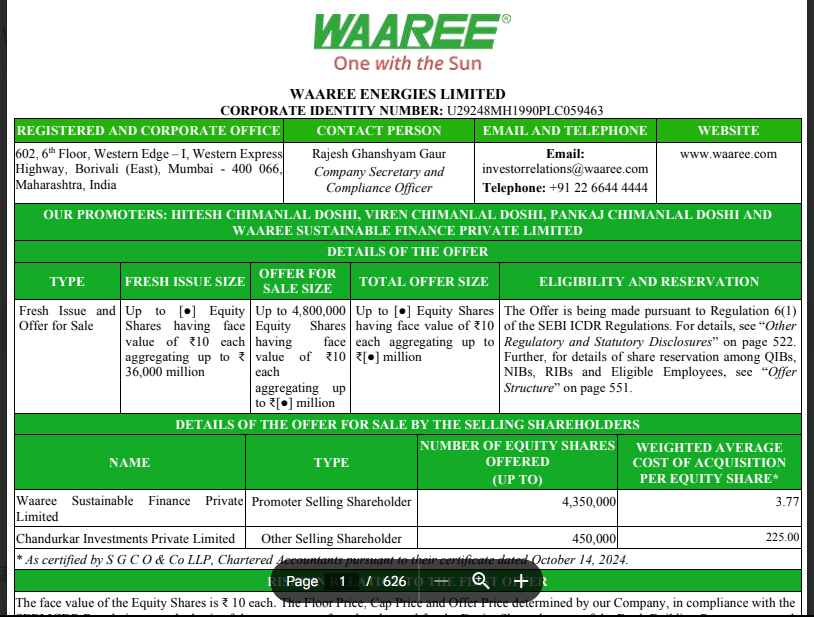

The total issue size aggregates to ₹4321.44 Crore, with a fresh issue of ₹3600 Crore and the offer for sale amounting to ₹721.44 Crore.

The IPO follows a book-building issue process and will be listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

The registrar for the Waaree IPO is Link Intime India Private Limited, and more information can be found on the official website, waaree.com.

How to apply for the Waaree Energies IPO in 3 seconds

Waaree IPO GMP:

| Waaree IPO GMP on 22 October | ₹1360.00 (90.5%) |

| Waaree IPO GMP on 21 October | ₹1,475.00 (98.1%) latest |

| Waaree IPO GMP on 20 October | ₹1,470.00 (98%) |

| Waaree IPO GMP on 19 October | ₹1505.00 (101%) |

As per Waaree IPO GMP today

Estimated Listing Gain for Retail category: ₹13,455.00

Estimated Listing Gain for NII category: ₹201825.00

Check All IPO GMP

Waaree 1st Day Subscription Status:

| Category Investors | Times |

| QIBs | 0.08 |

| HNI (Above 10 Lakh) | 7.08 |

| HNI (Above 2 Lakh) | 9 |

| Retail | 3.15 |

| Employee | 1.48 |

| Total | 3.22 |

Waaree IPO GMP and Dates:

| Opens on | 21 October |

| Closes on | 23 October |

| Allotment on | 24 October |

| Refunds on | 25 October |

| Demat Transfer | 25 October |

| Listing on | 28 October |

Waare Energies Ltd IPO Performance:

The key performance indicators (KPIs) for the Waare Energies Limited IPO provide insights into the company’s financial health and operational efficiency. The Return on Equity (ROE) stands at 8.79%, while the Return on Capital Employed (ROCE) is slightly higher at 9.45%. The company’s low debt-to-equity ratio, at just 0.06, indicates a strong balance sheet with minimal reliance on debt.

The Return on Net Worth (RoNW) is 8.81%, and the Price to Book Value (P/BV) ratio is 8.84.

The Waaree’s Profit After Tax (PAT) margin is 11.47%, reflecting solid profitability. Earnings per share (EPS) before the IPO are ₹48.69, which increases to ₹56.16 post-IPO.

Additionally, the Price-to-Earnings (P/E) ratio decreases from ₹30.87 pre-IPO to ₹26.76 post-IPO, indicating improved valuation for investors post-listing.

Waare Energies Ltd IPO Financials:

The Waaree’s financial performance has shown substantial growth over recent years. As of June 30, 2024, the company’s assets stand at ₹11,989.48 Crore, a rise from ₹11,31.73 crore in March 2024 and significantly higher than the ₹7,419.92 crore, recorded in March 2023. Waaree’s revenue for the quarter ending June 2024 is ₹3,496.41 crore, with full-year revenue from March 2024 reaching ₹11,632.76 crore, up from ₹6860.36 crore in March 2023.

Profit After Tax (PAT) also reflects a strong upward trend, from ₹79.65 crore in March 2022 to ₹500.28 crore in March 2023, and a substantial ₹1274.38 crore in March 2024. For June 2024, PAT is ₹401.13 crore. Net Worth has increased to ₹4,471.71 Crore by June 2024, up from ₹4,074.84 crore in March 2024 and ₹1,826.02 crore in March 2023.

The company’s reserves and surplus have grown considerably, from ₹23043 crore in March 2022 to ₹3,825 crore by March 2024. Total borrowing has decreased to ₹261.24 crore in June 2024 from ₹317,32 crore in March 2024, reflecting a strategic effort to manage debt effectively.

The Waare Energies Ltd IPO Objectives:

The Waaree IPO aims to raise funds for two key objectives. First, it will partially finance establishing a large-scale manufacturing facility in Odisha, India, dedicated to producing 6GW of ingot wafers, solar cells, and solar photovoltaic (PV) modules.

This project is part of Waaree’s efforts to strengthen its position in the renewable energy sector. The second objective involves utilizing the funds for general corporate purposes, which will support the company’s overall operations and growth strategy.

Waare IPO Strengtha and Risks:

Before investing in Waaree, it’s important to consider both the strengths and risks associated with the company.

Waaree IPO Strengths

- Waaree is the largest solar PV module manufacturer in India, with an impressive production capacity of 12 GW.

- The company has shown strong financial growth, achieving a remarkable 99.83% compound annual growth rate (CAGR) in revenue.

- With a diverse global customer base and an order book of 16.66 GW, Waaree is well-positioned to meet future demand.

- Additionally, the company operates a vast retail network across India, consisting of 369 franchisees as of 2024.

- Waaree’s ISO-certified manufacturing facilities ensure that its products meet global quality standards.

- Finally, its backward integration strategy enhances operational efficiency by reducing dependency on imports.

These factors highlight the company’s solid market standing and long-term potential.

Waaree IPO Risks

While Waaree shows great potential, investors should also be aware of several risks.

- The company relies heavily on its top 10 customers, which contribute 56.77% of the total revenue, creating a concentration risk.

- In FY2024, Waaree incurred significant liquidated damages of 1,724.27 million, which impacted its profitability.

- The company’s high dependency on export sales, accounting for 57.64% for revenue, exposes it to global market fluctuations.

- Additionally, 54.08% of Waaree’s expenses come from importing materials from China, making it vulnerable to supply chain risks.

- Waaree is also expanding its U.S. manufacturing operations at an estimated cost of $70 million, which presents both growth opportunities and financial risks.

- Lastly, financial uncertainties remain a concern, with outstanding borrowings of ₹12,701.91 million as of 2024.

Waare Limited IPO Promoters Holdings:

The Waaree IPO highlights significant details regarding its promoters and shareholding structure. Before the issue, the promoters collectively held a 72.32% stake in the company.

Key promoters include:

- Hitesh Chimanlal Doshi

- Viren Chimanlal Doshi

- Pankaj Chimanlal Doshi

Along with Waaree Sustainable Finance PVT LTD.

These stakeholders will continue to play a critical role in the company’s future trajectory following the IPO. This shareholding information provides insight into the company’s leadership and financial dynamics, crucial for potential investors to assess stability and long-term growth.

Waaree IPO GMP and Anchor List:

Waaree IPO Lead managers:

The Waaree IPO is supported by a robust team of lead managers, providing crucial financial advisory and support throughout the process. The prominent lead managers include Axis Capital Limited, IIFL Securities Ltd, Jefferies India Private Limited, and Nomura Financial Advisory and Securities,

Additionally, SBI Capital Markets Limited, Intensive Fiscal Services PVT LTD, and ITI Capital Ltd are key players ensuring the smooth execution of the IPO. Their involvement brings creditability and ensures that the offering is well-structured, providing confidence to potential investors.

Check Waaree IPO GMP and Live Subscription

About the Waaree Energies Limited Company:

The Waaree Energies Limited, founded in December 1990, is one of India’s leading manufacturers of solar photovoltaic (PV) modules with an impressive installed capacity of 12 GW. The company operates four state-of-the-art manufacturing facilities spread across 136.30 acres in Gujrat, India, especially in Surat, Tumb, Nandigram, and Chikhli.

These facilities adhere to international standards, including ISO 45001:2018, ISO 14001:2015, and ISO 9001:2015, reflecting Waaree’s commitment to safety, quality, and global excellence. With a diverse product portfolio that includes multicrystalline, monocrystalline, TopCin, and bifacial PV modules framed and unframed along with building-integrated photovoltaic (BIPV) solutions.

Waaree is positioned as a key player in the renewable energy space. By June 2023, the company had built a strong, diversified customer base both domestically and internationally, leveraging its robust retail network and solid financial performance. With over 1000 full-time employees and an experienced management team, Waaree Energies is poised to meet the growing global demand for renewable energy solutions.

Waare IPO GMP, subscription, review conclusion:

The Waaree IPO GMP has been indicating a positive note. Waaree IPO GMP maintains between 98% and 105%. As per the latest Waaree IPO GMP, the estimated profit for the retail category is approximately ₹13455.00 and the estimated profit for the HNI category is ₹201825.00. The Waaree IPO is open to bid now. The Waaree IPO closes on 23 October at 5 PM. 1st Day subscription rate is 3.22 times. At the end of the 2nd day, the subscription is x

We hope you enjoyed and got an update from Waaree IPO Day 2: Subscriptions status & Best GMP Trends

Hi, I’m Avishek, a passionate stock market enthusiast turned full-time investor. With my 3+ years of experience in the Indian and Global markets, I’ve developed a keen eye for potential winners. My portfolio includes successful allotments in IPOs from NYKAA, Bajaj Housing Finance, Waaree Energies Ltd, and more. I have never lost money in the stock market. Through this blog, I will provide all the information here.